Take the long view

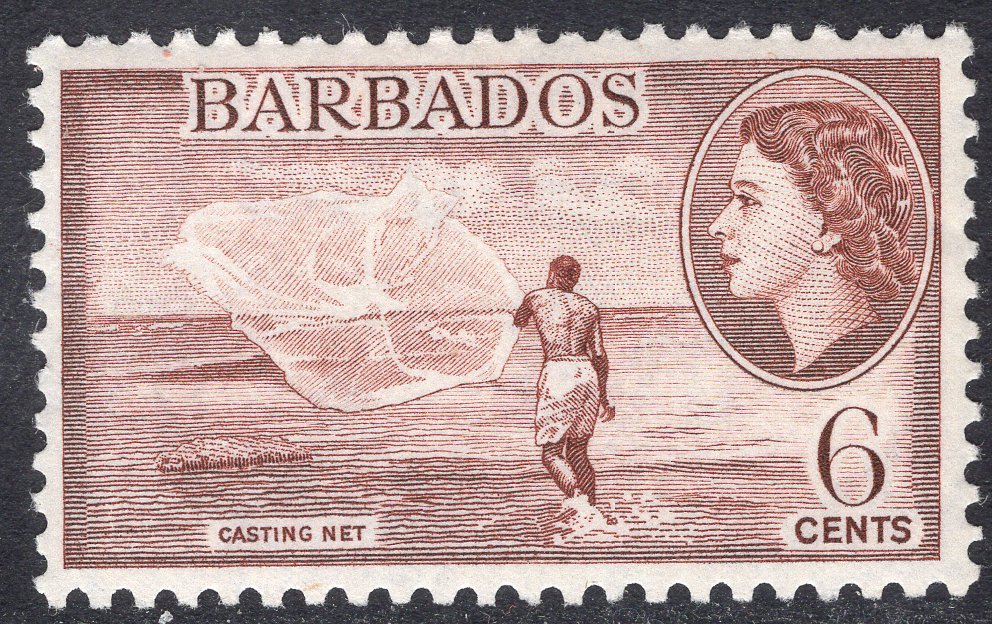

Cast a wide net

Think apart from the crowd

View the world through a non-interventionist lens

“To outperform over time, managers must find edges that enable them to earn excess returns. We believe that we have real edges as a firm, such as our truly long-term focus and flexible investment mandate (including holding significant cash balances). In today's frenetic marketplace, these edges seem more enduring than ever.”

— Seth Klarman